In

these days of economic uncertainty it is essential that people

have a sense of security and peace in terms of their future. Long

term care insurance is a way to help preserve that.

"Your future will happen whether you plan for it or not." TM |

|

The most frequent questions are:

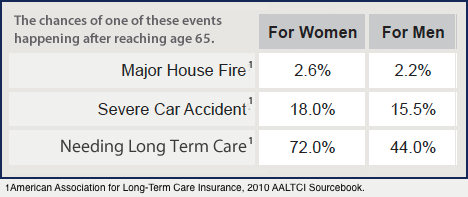

"Will I ever need long term care?"

The fact that this cannot be known in advance and can happen at any time creates the necessity for planning. You may be insurable today but not tomorrow.

Of those currently receiving long term care 40% are under 65 and the Govt. Accounting Office predicts that 70% of Americans over 65 will need long term care. Long term care needs will only increase with the aging boomer population.

"How much does long term care insurance cost?"

Like other insurance it depends on how much of the risk you want to insure. Your age and the benefits you choose will determine the premium. We can help you design the most appropriate and affordable plan, provide a quote, and help you apply for California long term care insurance.

The cost for long term care insurance in California can be different than other states.

Since we represent all the major California insurance carriers, the premiums will be the same if you buy your insurance through us or somewhere else. As independents we work for you, not for the insurance company.

For some traditional long term care insurance might not be the best choice or maybe they can't health qualify. At California LTC we offer multiple solutions for every financial and health situation such as long term care insurance, life insurance with a long term care rider and a deferred annuity with a long term care rider.

With our quote service you can get competitive quotes from the different long term care insurance companies.

Your California long term care insurance you purchase from us is usable in any state in the U.S. and in most foreign countries.

Contact us if you have any questions about international coverage since some policy benefits are different.

We also provide the California Long Term Care Partnership policy.

1. American Association for Long-Term Care Insurance, 2010 AALTCI Sourcebook.

2. Activities of Daily Living (ADSs) indluce: Bathing, Continence, Dressing, Eating, Toileting and Traferring as defined in the Policy.

Agent: Michael McDonnell

CA Lic # 0D90327

PO Box 5894

Petaluma, CA 94955