|

Annuity With Long Term Care Benefits

A popular alternative to standard LTC insurance and refered to as a linked benefit product.

Are you looking for a way to leverage your investments to include protection from the risk of expensive long term care?

Have you been turned down (declined) for long term care insurance or does you health prevent you from applying for long term care insurance?

If you answered yes may want to consider an alternative to spending down your own nest egg to pay for long term care.

There are two types of annuities with long term care benefits. One requires health underwriting and one does not. Both are single premium fixed annuities with a long term care rider designed to cover long term care expenses. There is also a Universal Life insurance policy with long term care benefits (underwriting required), more information here.

The annuity with no underwriting provides access to long term care benefits without depleting your principal, you avoid invasive medical questions, and you can pay for in-home care. (NOTICE: This annuity is unavailable at this time, contact us and we will let you know when it is available again.)

Both annuities will provide you with financial security and long term care peace of mind with extended care protection. The annuity with underwriting will have better leverage (benefits) than the annuity without underwriting, but if you cannot health-qualify your only choice is the annuity without underwriting.

The best candidates for these annuities are: uninsurable, those needing care, those with existing annuities that can transfer money to an new annuity

with LTC benefits and the new 1035 exchange rules provide tax free options to fund a traditional LTCI policy. These are not investment or income annuities.

Q: What has changed since the Pension Protection Act?

A: Read about these changes here. (new window)

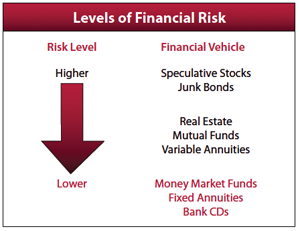

Q: But aren't annuities risky?

A: Not fixed annuities, they are similar to your bank's CDs, and no one has lost money on a fixed annuity. In fact they may pay a higher rate than your CD and Money Market account.

Q: How does this work?

A: Most clients simply reposition money from an existing CD, Money Market or Savings Account. When you need long term care you will have long term care benefits available.

Q: What happens to the annuity?

A: It just keeps growing. You can take up to 10% out per year without any surrender fee, after the deferral period that you can take as much as you want out, for any reason, you could even pay for long term care expenses if your care extended past the term that the rider covers. If you should die at any time the annuity money (less any withdraws) goes to your beneficiaries.

Q: Can I use my IRA money or one of my old 401k's to fund the annuity?

A: For ages over 59 1/2. Underwriting required. If available in your state, you can do a 1035 exchange or "trustee to trustee transfer" to reposition the money to fund the annuity from a 401k/IRA account, even from multiple qualified accounts. You can use up to 60% of your entire qualified money. Also spouses can share benefits with one spouses qualified money even if one spouse is under 59 1/2. Caveat: Using qualified money means your LTC benefits are taxable, consider the Life/LTC, qualified money benefits are not taxable.

Click for Qualified vs Nonqualified Money (new window)

Q: I have an existing annuity can I do a 1035 exchange

A: Yes, it would be simply a rollover to a secure account that has the long term care rider.

Q: Can the owner of the annuity and the annuitant be a different person?

A: Yes, in fact boomers are buying this for their parents who are either uninsurable or long term care insurance is just too expensive because of their parents age.

Q: How much is the long term care benefit?

A: It depends on the type of annuity, whether it has underwriting, how much you put in the annuity and your age when you start the annuity.

Q: Is this available to anyone, everywhere?

A: The rider is available for those who have not needed or received care service within one year prior to the starting date. Not all products are available in all states. Check with us about current state and age availablilty.

Q: How do I find out if this is right for me?

A: Thousands of Americans just like you have decided to protect their nest egg and have long term care benefits with our annuity. Call us, email us or fill out our online form and one of our licensed specialists will answer all your questions.

Call Toll Free: 1-888-582-2464

Monday - Saturday 9-6 PST

Click Here To Get An Annuity With LTC Benefits Quote

|